WATCH OUR BITCOIN EXPLAINER VIDEO SERIES

How and why is the Crypto Consensus Wrong?

For our most in-depth explanation of why we think the cryptocurrency consensus is mistaken about the value of Bitcoin and how the majority arrived at this position, download our free ebook.

“How a Scalable Blockchain Will Win” is available in PDF, on Kindle, and in audiobook on Audible.

Unbounded capital’s Scalability Research

We are convinced that the future of blockchain belongs to the most highly efficient and scalable option. We define a “scalable blockchain” as a blockchain which sees transactions gets cheaper and more efficient as transaction volume increases.

After years of research and major pivots in our investment focus, the only blockchain we think currently has a chance of scaling to meet global demand is Bitcoin SV, although we are constantly looking to see if there are other emerging scalable blockchains that could match or surpass Bitcoin SV on this key metric.

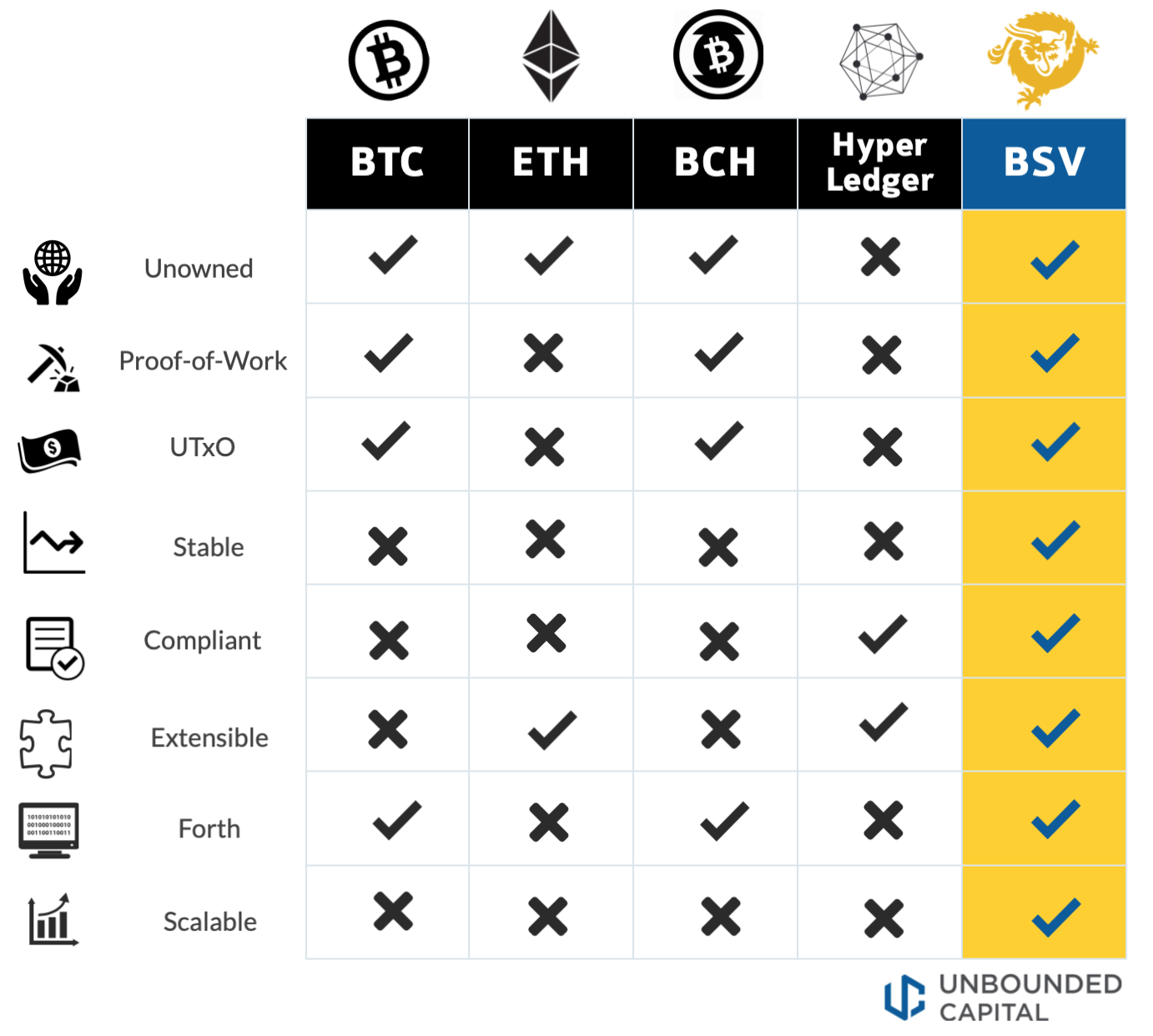

the Only Complete Blockchain System

Unowned: By having no owner, BSV is not tied to the success of any one business. Further, there is no entity that can bar, delete, or alter content, making it a public system. This is in contrast to a network like Hyperledger, which is used to create private blockchains.

Proof-of-Work: Proof-of-Work brings accountability and competition to network operators. Alternatives like Proof-of-Stake, the desired outcome of ETH 2.0, provide neither.

UTxO: In UTxO systems, ordering is explicit which is key to scalability. Legacy account-based systems like Ethereum will not be able to scale to the degree that a UTxO system can.

Stable: BSV is oriented around a stable protocol giving business a solid foundation. Most other blockchain networks treat protocol like software, adding cost and complexity.

Extensible: BSV comes with a scripting language that can be used for smart contracting and computation. Other Bitcoin forks, most notably BTC, have removed this functionality.

Compliant: BSV's transparency makes compliant use of the network simple. Most other blockchain networks seek to remove transparency making compliance extremely difficult.

Scalable: Only BSV is built for long-term scale. Its technical UTxO design and the economic system of Proof-of-Work provide the structure and incentive to scale. Other blockchains have structural errors and other Bitcoin forks, like BTC, are intentionally limited and have introduced structural errors.

Forth: BSVs scripting language is based on Forth, A Forth-based language is necessary for Bitcoin's economic design and will facilitate long-term use in embedded devices and ASICs.

Explore BSV As We did in our Essay Series from 2019

When we first began our research into Bitcoin SV in early 2019, we outlined our thought process in real time as we began to understand the who, what, where, when, why, and how of the opportunity in Bitcoin. We also attempted to answer the important question of what was causing the confusion we were identifying in the blockchain and cryptocurrency space.

“What” is going on?: Fractals and Contrarian Consensus

This essay (part I) attempts to answer how we found ourselves in this situation where general crypto consensus appears at odds with reality.

“Where” is the problem?: BTC, Small Blocks, and Lightning Network

This essay (part II) looks into this hidden reality and outlines potential problems with crypto consensus that are largely unaccounted for, and as a result, not appropriately reflected in the price of assets.

“Why” BSV?: Darwinian Fitness and Irrational Markets

This section of this essay (part III) explores the mechanics of forking and investigates what it means for the investor. It also investigates possible investment theses and hedging approaches that stem from forking. On a high level it attempts to introduce a useful crypto-relevant heuristic via simple biological analogy.

“How” did we elect thought leaders?: Complexity’s Preference for Genius over Excellence

This essay (part IV) is a high level look into how we arrived at our crypto consensus. What methodology and epistemology are implicit in this process? Did we actively decide to use these tools? Are they the best tools for the job?

“When” to make an investment: A Conclusion

This essay (part V) is a conclusion. What is the take away of the series? Where can we look to continue this exploration?