As we described in chapter 2, blockchain has seen very limited usage to this point. Even with billions of dollars raised and a quarter of a trillion dollars worth of crypto in existence, actual usage of blockchain-based applications is miniscule. One mild exception is the area of DeFi, a shorthand for decentralized finance. In a February 2O2O Coindesk article titled Why DeFi’s Billion Dollar Milestone Matters, writer Brady Dale wrote that “It was only December when the entire decentralized finance (DeFi[ market was worth less than $7OO million. Early this morning, it hit $1 billion, a figure that even the most fervent blockchain skeptics would have a tough time dismissing as meaningless.”

While that number has dropped down to $848M at the time of this writing (5/2/2O2O[, this level of activity still dwarfs all other blockchain apps. What is the opportunity seen in DeFi? In their Mega Crypto Theses, Multicoin Capital describes the opportunity for Open Finance, their preferred terminology for the sector.

By making units of value—stocks, bonds, real estate, currencies, etc.—interoperable, programmable, and composable on open ledgers, capital markets will become more accessible and efficient. Just as the proliferation of capital markets over the last 100 years enabled staggering levels of wealth creation, open finance will make capital markets more efficient and accessible to everyone on the planet.

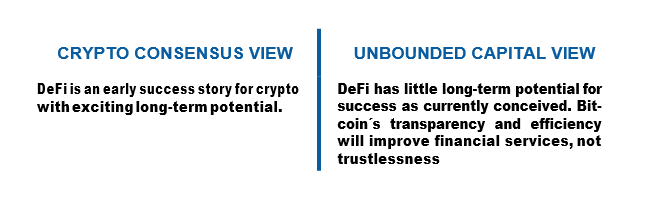

At Unbounded Capital, we fully agree with this thesis. However, we think that the current generation of DeFi protocols are doomed to fail for the same reasons as the protocols they are built on. The current generation of DeFi is happy to sacrifice efficiency to achieve greater trustlessness and censorship resistance. In our view, it is not these qualities but rather transparency and efficiency that will improve the current array of financial services and create opportunities for new players who can effectively leverage BSV.

DeFi MAXIMIZES FOR TRUSTLESSNESS

Multicoin Capital makes it clear in their Mega Crypto Theses that they believe the success of open finance will be rooted in trust-minimization.

We cannot overstate the magnitude of this breakthrough. For the flrst time, flnancial markets can be global, permissionless, and for many kinds of derivative contracts, free of counterparty risk. This was impossible until recently.

The world’s flnancial market infrastructure will move to the Open Finance stack because the Open Finance stack enables millions of businesses—those that are local, national, and international in scale—to offer trust-minimized financial products to the people and businesses who need them most.

As we established in chapter 3, trust-minimization is not actually the removal of counter- parties or trust. Rather, it is the substitution of traditional businesses for autonomous code as a counterparty. Just examining the most recent month in DeFi reveals these counterparties to be far from trustless.

Consider MakerDAO as an interesting example. MakerDAO is a multi-faceted platform. It allows crypto-asset holders on Ethereum to lock collateral, typically ETH, to produce a stablecoin called Dai. That collateral is managed algorithmically to keep Dai pegged at one dollar. Governance of the system is done by holders of a separate token, M0R. MakerDAO is the leading DeFi protocol. More than half of all collateral locked in DeFi is locked into MakerDAO. At the time of this writing (5/2/2O2O[ there is $457M of collateral creating $98M worth of Dai governed by $35OM worth of M0R. Andreesen Horowitz, a VC firm which recently raised a $515M crypto fund, was an investor in M0R.

MakerDAO is often compared to Tether, the leading stablecoin in the Crypto space with over $8B in supply with daily volume occasionally exceeding $1OOB. Tether is operated by Bitfinex, a major cryptocurrency exchange. Tether is often criticized for being centralized. Bitfinex has had legal issues with New York State. According to Tether’s own lawyer, at one point Tether was only 74% backed by cash or equivalents.

In their piece An Overview of Stablecoins, Multicoin Capital describes the functioning and potential issues of a centralized stablecoin like Tether.

The first [method of issuing stablecoins] is to issue lOUs. This is the model used by tokens like Tether and Digix. Here, a centralized company holds assets in a bank account or vault and issues tokens that represent a claim on the underlying assets. The digital token has value because it represents a claim on another asset with some deflned value. The problem with this approach is that it is centralized. These tokens require trust in the issuing party – that they actually own the assets being represented and that they are willing to honor the IOUs. This model imposes serious counterparty risk on holders of the token. Tether is the canonical example given the serious concerns that the public has about their solvency and legitimacy.

We agree that the solvency and legitimacy of Tether is a serious concern. What is interesting is that a community that values decentralization, trustlessness, and censorship resistance so regularly opts to use a centralized stablecoin. If the existing crypto community does not value decentralization in practice, it is strange that they tend to be so bullish on the ultimate success of decentralization. The reality is that traders greatly prefer using tether. Tether has held its peg much more effectively than Dai. Even with as untrustworthy a counterparty as Bitfinex, their incentive to keep Tether backed is enough to assure Tether users. If a more reliable counterparty took on this role, it appears likely that they would dominate over decentralized models.

This concern that crypto traders have with MakerDAO may be well founded. In fact, Coindesk reported on April 14th that MakerDAO is currently being sued by its users in a class action lawsuit.

The suit alleges the Maker Foundation and associated parties – including the Maker Ecosystem Growth Foundation, the Dai Foundation and the Maker Foundation – “intentionally misrepresented the risks associated with CDP ownership” resulting in the loss of $8.325 million in investors’ money on Black Thursday.

This is far from the first issue that users have had with DeFi protocols, and it wasn’t the last. Multicoin Capital’s most recent public investment was leading a $1.5M seed round in Chinese DeFi company dForce. Their platform Lendf was subsequently hacked for $25M dollars due to a vulnerability in one of the modular financial primitives it relied upon. In a stroke of extreme fortune, the money was returned and disaster was avoided. Involving law enforcement reportedly helped the issue. By now, it should be obvious to DeFi investors that code is not a risk-free counterparty. Further, the possibility that stolen or misplaced funds cannot be retrieved will be a non-starter for institutions.

DeFi SUCCESS IS A FALSE POSITIVE

DeFi is an extension of the true current crypto success story, trading. Speculators have had a field day in cryptocurrencies. The largest businesses by far are crypto exchanges. Unbounded Capital has no problem with speculation, but it is important to recognize that this speculation may be a temporary state. If one network emerges from the pack as the dominant blockchain, how much intra-crypto asset trading will be necessary. In our view, large exchanges have been complicit in propagating a narrative that crypto is unscalable and that tradeoffs are necessary. This is great for their business since a world with hundreds of protocols and tokens is much better for these exchanges than a world built on Bitcoin.

DeFi today is an extension of this trading dominated reality. crypto-asset holders have very little that they can do with their assets. While they hold these assets, platforms which allow them to earn interest or gain leverage are very useful. Many traders are happy to get better rates by accepting greater risk through assuming autonomous code as a counterparty instead of traditional counterparties. Many services are also not offered by traditional counterparties for certain cryptoassets, making DeFi necessary in these cases. What this means is that growing DeFi usage today is not necessarily a trend that should be expected to continue.

HOW BITCOIN IMPACTS FINANCE

A consistent message from Multicoin Capital and similar investors is a desire to use blockchain to help bank the unbanked and increase access to financial services around the world. We share this goal. However, we think that the key to increasing access is to increase efficiency. The lack of access to these services for much of the world is much more likely an issue of costs and benefits and not an issue of trust or censorship. We believe that Bitcoin’s efficiencies will reduce these costs and make providing services to more of the world economically feasible. We also think that the centralization of information on Bitcoin will make coordination by financial institutions far easier and that this will expand the reach of existing services and make new products and services possible. Increased transparency will help make the financial world more reliable. Replacing businesses with autonomous code will not.